For businesses looking to import goods into or export goods from Australia, particularly through the bustling port and air hub of Perth, navigating the labyrinthine world of customs regulations can feel like a daunting task. This is where a customs broker in Perth becomes not just a convenience, but an absolute necessity. Far more than just paperwork pushers, these licensed professionals are the unsung heroes of international trade, ensuring your goods move smoothly, compliantly, and cost-effectively across borders.

So, what exactly does a customs broker in Perth do to make your trade seamless? Let’s break down their multifaceted role.

1. Expert Interpretation of Australian Customs Law:

The Australian Border Force (ABF) and other government agencies (like the Department of Agriculture, Fisheries and Forestry – DAFF) have some of the most stringent and complex import/export regulations globally. A good customs broker in Perth possesses an in-depth, up-to-the-minute understanding of:

• Tariff Classification: They accurately classify your goods under the Harmonized System (HS) codes. This is crucial as it directly determines the rate of customs duty and GST applicable. Misclassification can lead to overpayment, or worse, penalties for undervaluation.

• Valuation: They ensure your goods are correctly valued for customs purposes, taking into account factors like freight, insurance, and other charges that contribute to the “Customs Value.”

• Prohibited and Restricted Goods: They advise you on items that are outright banned or require special permits (e.g., certain foods, plants, medicines, firearms, chemicals). This prevents your goods from being seized or held indefinitely.

2. Biosecurity and Quarantine Compliance (DAFF):

Australia’s unique ecosystem means it has extremely strict biosecurity laws. A Perth customs broker is an expert in DAFF (formerly AQIS) requirements, which is vital for preventing delays and potential fines. They handle:

• Import Permits: Identifying if your goods require specific import permits from DAFF.

• Treatment Requirements: Advising on necessary treatments (e.g., fumigation for wooden packaging materials, heat treatments for certain commodities) to eliminate pests and diseases.

• Documentation: Ensuring all biosecurity-related documents, such as packing declarations and health certificates, are accurate and submitted correctly.

• Inspection Facilitation: Arranging and managing any required DAFF inspections at the border.

3. Meticulous Documentation and Electronic Lodgement:

Paperwork errors are a leading cause of customs delays. Your Perth customs broker handles all the intricate documentation:

• Preparing and Submitting Declarations: They electronically lodge Full Import Declarations (FIDs) and other necessary forms with the ABF’s Integrated Cargo System (ICS) on your behalf.

• Supporting Documents: Managing and submitting all accompanying documents like commercial invoices, packing lists, bills of lading/air waybills, certificates of origin, and any required permits or licenses.

• Record Keeping: Maintaining accurate records for the required period, which is essential for compliance audits.

4. Duty and Tax Optimization:

Beyond simply paying duties, a skilled broker actively seeks ways to minimize your costs legally:

• Free Trade Agreements (FTAs): Identifying if your goods qualify for preferential tariffs under Australia’s various FTAs (e.g., with the UK, US, China, ASEAN nations, India, etc.).

• Tariff Concession Orders (TCOs): Assisting in applying for TCOs if there’s no commercially equivalent good produced in Australia, potentially reducing or eliminating duty.

• Duty Drawbacks and Refunds: Helping you reclaim duties paid on imported goods that are later exported or used in specific manufacturing processes.

• GST Deferral: Advising on options for deferring Goods and Services Tax (GST) payments.

5. Liaison and Problem Resolution:

Acting as your primary point of contact, the customs broker communicates directly with government agencies on your behalf. If issues arise (e.g., discrepancies, holds, requests for more information), they are your advocate, working to resolve problems swiftly and efficiently.

6. Comprehensive Advice and Consultancy:

Many Perth customs brokers offer broader trade consulting services, advising on:

• Supply Chain Optimization: How to streamline your import/export processes.

• New Market Entry: Guidance on regulations for new products or target countries.

• Compliance Training: Helping your internal team understand essential customs requirements.

In essence, a customs broker in Perth acts as your indispensable guide through the complex world of international trade, ensuring your goods navigate Australian borders with maximum efficiency and complete compliance, allowing you to focus on your core business.

What Exactly Does a Customs Broker in Perth Do? Your Essential Guide to Seamless Trade.

Posted by

–

Follow Us

Recent Posts

-

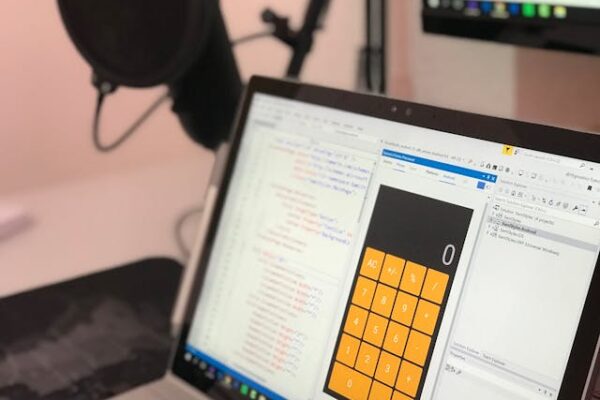

Transforming Digital Visions into Reality: Choosing the Right Mobile App Development Company in Bahrain

-

When Is the Cheapest Time to Book Flights? A Complete Guide

-

Builders in Winchester: A Complete Guide to Finding the Right Experts for Your Project

-

The Benefits of Using a Solar Carport for Clean Energy

Tags

#technology airline airlines american airlines customer service anti-virus asacc sdca business Chat Coinbase coinbase support number Crypto.com support number Email Expedia expedia customer service faq fashion helping Jetblue norton or Chat Options: Step by Step Guide qb quickbooks QuickBooks Payroll Support Number Service Support travel travels UnitedAirlines United Airlines werty

Leave a Reply

You must be logged in to post a comment.